Chart Patterns for a Direction Change

When price changes direction it can only really do so in five different ways. One way is a sudden and without warning which I won’t discuss in these basic lessons. The other four are more organized and user-friendly. They all easy to read but will not always be as perfect as these examples, just very close. Let’s take a look at them in-depth and you will have them all mastered in no time. There is a theme of a ‘double-tap’ with all of these patterns as you will soon discover. This provides proof that order flow exists at the prices in question.

The explanations given below on the trades that these patterns provide will make more sense to you once you have completed all of the lessons. Try not to worry too much about the details of the trade execution itself at this part of the course. Your main focus should be on the patterns themselves and understanding how and why they form. Everything needs to be introduced one piece at a time.

Double Tops and Double Bottoms – Double Taps

A price point reacts, is returned to, and reacts again within a few pips.

In the case of bearish pressure, the sellers are trying to take back control. A wave of selling occurs and then the following wave of buying returns to the exact same price and selling commences once more. There are a couple of options available when trading this direction change. You can be part of that 2nd tap itself and trade the wave down from the top, or you can trade the pattern as a whole once it confirms the double top by by creating a lower low.

In the case of bullish pressure, the buyers are trying to take back control. A wave of buying occurs and then the following wave of selling returns to the exact same price and buying commences once more. There are a couple of options available when trading this direction change You can be part of that 2nd tap itself and trade the wave up from the bottom, or you can trade the pattern as a whole once it confirms the double bottom by creating a higher high.

What you are doing here is anticipating the change of direction. The initial reaction that occurred from the #1′s on the above images shows you that a price point is active, once price returns there you will want to be part of the next wave that originates at the #2′s in the image. Alternatively, the horizontal colored lines represent the neck line of the pattern and you could trade the break of in order to enter. You could also trade both!

Head and Shoulders – Split Double Taps

Similar to the double tops and bottoms in their double tap concept but there is a peak in the way, the head.

In the case of bearish pressure, the sellers are trying to take back control. A wave of selling occurs and then the following wave of buying is weak allowing the sellers to start again at a lower high. This lower high lines up perfectly with another high just 2 peaks back. There are a couple of options available when trading this direction change. You can be part of that last wave down in the image, or you can trade the break of the pattern itself as it confirms the lower high by creating a lower low.

In the case of bullish pressure, the buyers are trying to take back control. A wave of buying occurs and then the following wave of selling is weak allowing the buyers to start again at a higher low. This higher low lines up perfectly with another low just 2 peaks back. There are a couple of options available when trading this direction change. You can be part of that last wave up in the image, or you can trade the break of the pattern itself as it confirms the higher low by creating a higher high.

Once again, what you are doing here is anticipating the change of direction. The double tap on this pattern is split in the middle by the peak that extends further out, but the 1-2 punch still remains. The #1’s and the #2’s in the image above are referred to as the ‘shoulders’ and the peak in the middle of them is called the ‘head’. That is how it gets its name but thinking of them as split double taps will work also. As price reacts again at the #2’s you will want to be part of the colored wave that follows. Alternatively, the horizontal colored lines represent the neck line of the pattern and the break of it can be used to enter. You could also trade both!

The neck line will present itself almost horizontal or slightly sloped. When it is sloped it will always be more powerful if the slope is towards the direction you are looking to trade. When it is sloped in the correct direction you can trade the break of the low, or high, instead of the neck line. Due to the structure of this pattern, if the slope was opposing the direction you wanted to trade, you would have a higher low followed by a lower high for a sell, or a lower high followed by a higher low for a buy. Either of those situations must be traded with more caution and based on a longer-term view.

The Ghosts – Split Double Taps

Similar to the head and shoulders but instead of shoulders it’s more like hands in the air, and similar to the double tops and bottoms but with a peak, or head, in the way again.

In the case of bearish pressure, the sellers are trying to take back control. The last wave of selling in the above image is the one that you would want to be part of, or you can use the break of previous low to trade the pattern itself as it creates a lower low. The best way to look at this pattern is to ignore the head and treat it as if it were a double top. The middle peak is just a failed first attempt at turning from the price point of the highest high in that image.

In the case of bullish pressure, the buyers are trying to take back control. The last wave of buying in that image is the one that you would want to be part of, or you can use the break of previous high to trade the pattern itself as it creates a higher high. The best way to look at this pattern is to ignore the head and treat it as if it were a double bottom. The middle peak is just a failed first attempt at turning from the price point of the lowest low in that image.

Yet again, what you are doing here is anticipating the change of direction. The double tap on this pattern is separated by a peak similar in concept to what you have just seen with the head and shoulders. The 1-2 punch of the double tap remains and the name ghost is simply a bit of fun because it resembles a child-like interpretation of a ghost with his hands in the air, or maybe it doesn’t and we are just crazy here at WaveFX Trading. The #1’s and the #2’s on the image clarify the double tap previously mentioned and you will want to be part of that latest colored wave which started at the #2’s. Alternatively, the horizontal colored lines represent the break of the pattern itself and can also be used as a trigger. You could also trade both!

The neck line will present itself completely horizontal or slightly sloped. When it is sloped it is strongly advised to only accept a slope that is towards the direction you are looking to trade. If it is sloped in the correct direction you can trade the break of the low, or high, instead of the neck line. If the slope is against the direction of your trade then, due to the structure of this pattern, you will have a higher low followed by a higher high for a sell, or a lower high followed by a lower low for a buy. Either of those situations must be traded with extreme caution and based on a longer-term view.

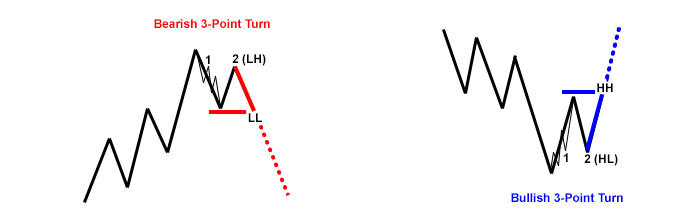

The 3-Point Turn – Layered Double Tap

The simplest pattern of them all is saved for last. It requires an understanding of the market layers in order to find it’s double tap so a tiny bit of complexity is added. Market layers will be explained in a later lesson but this will serve as a good introduction to the concept.

In the case of bearish pressure, the sellers are trying to take back control. A wave of selling occurs and then the following wave of buying is weak allowing the sellers to start again at a lower high. There are a couple of options available when trading this direction change You can use resistance from a lower market layer to be part of that lower high, or you can trade the pattern itself as it confirms its lower high by creating a lower low.

In the case of bullish pressure, the buyers are trying to take back control. A wave of buying occurs and then the following wave of selling is weak allowing the buyers to start again at a higher low. There are a couple of options available when trading this direction change You can use support from a lower market layer to be part of that higher low, or you can trade the pattern itself as it confirms its higher low by creating a higher high.

When you anticipate the change of direction with this pattern you are doing so without a visible double tap. The double tap is a theme for a reason and with this pattern there will be no exception but you will need to look closer. If you imagine that all of these patterns are happening on different layers and of a different magnitude then you should have a rough idea of what the layers are. Let’s put that into an image to clarify.

Now you should understand the 1-2 punch of the double tap. This pattern may require you to be able to read the market on multiple layers but it is a very powerful pattern. There is no real hesitation with this pattern making it a very decisive move. As price reacts at the #2’s in that image you will want to be part of the colored wave that follows. Alternatively, the horizontal colored lines are also a great trigger point to trade. You could also trade both!

This pattern is like a head and shoulders that only has one shoulder when you think about it, or it is the pattern that you will see before a ghost. Between the four different patterns on this page, you will able to prepare for nearly every scenario of a direction change that can occur.